Page 19 - link magazine

P. 19

The Link Magazine• February 1994

19

Advertising Feature

Fixed rate mortgages.. are they really a good idea? r'

Mike Rees of Mortgage Brokers Mansfield Begie Associates answers the question v(ne

We have been asked many times At present there are excellent deals All of this together with the general wid 9(t &a9kaWA6

over the past 12 to 18 months available for all borrowers, particu- opinion that we are coming out of

whether it makes good sense to take larly first time buyers, with fixed the recession, leads to the logical FLOWERS

out a new fixed rate mortgage over rates as low as 4.99% (95% maxi- conclusion that there has neverbeen yi.it 1th flowers

a set term, ranging from 2 years up mum loan to value) over 2 years. a better time to enter the property Roses i ilngles, box,

to 10 years. Our answer has been Many clients (existing borrowers) market, with property prices static cylinder or tube, heart/

that it makes sense to ensure your and with low interest rates. How- design or, small cone f

monthly mortgage payments stay have complained that lenders seem ever, in order to ensure a constant Roses gift wrapped i

the same, particularly at a time when to encourage new borrowers with monthly payment, the ideal solu- 12, 20, etc.

no proven track record by offering

/

interest rates have hit their lowest them better deals than some who tion is to take on a competitive fixed /

levels for the las t25 years. 12 months have had mortgages for years with rate together with optional mort- SPEC tAyALE1?hNE

ago the average mortgage rate was excellent payment history. We are gage protection cover (accident, sick- BASKETS

8.55%, and it is now 7.75%, a drop of pleased to say that the trend seems ness and redundancy) to coveryour VALENTINE

0.8%. The general consensus is that, total monthly outgoings in connec- ARRANGEMENTS

if any changes in rates occur, they tobechanging, particularly for those tion with the mortgage in case of WITH OR WITHOUT

who need to borrow up to 100% to

will fall again, probably by another move up-market but have little or any unforeseen problems.

0.5% to 0.7%. ROSES

no equity in their present house, as Therefore, fixed rates are an excel-

Some clients have been using this as there is now an equity replacement lent idea, but longer term rates tend BALLOONS

a sound argument for 'staying put' scheme available at a fixed rate of to tie you in to that particular lender Say it with a special

on a variable rate until the rates 4.99% over 2 years, eg £75,000 re- and there could be high penalties message on a balloon

drop and fixed rates come down as quired to purchase a property for (up to 6 months interest) on early or as a surprise in a

well. However, as none of us (even £75,000 would cost 1280.69 net per redemption, so you have to be as box (balloon floats out

Mr Clarke) have the benefit of a month, interest only (excluding in- sure as you can that you will not on opening).

crystal ball, this, in our opinion is surance) for the fixed rate period, want to move house during the fixed FLOWERS FOR ALL

taking a big gamble, as it only takes with the opportunity to move onto rate period. OCCASIONS

a change in world markets, let alone another fixed rate at the end of the 2

the UK economy to see rates chang- years. If you need further information, we WEST END FLOWERS

ing the other way. Even in January have access to all the major lenders 126 RODBOURNE ROAD

1993 when the variable rate was Some lenders,although they are very in the UK, so we can select the right (by Bruce Street roundabouts

8.55% you could get a fixed rate over selective, are also offering existing mortgage product to suit your indi- on Great Western Way)

3 years at 7.5% which is lower than borrowers with negative equity a vidual needs. Please telephone

chance to move with the negative (0793) 873369 for advice and infor- Tel: (0793) 436262

the present variable rate.

equity. mation. Telephone orders welcome.

Access and Visa available

K IING M YE!

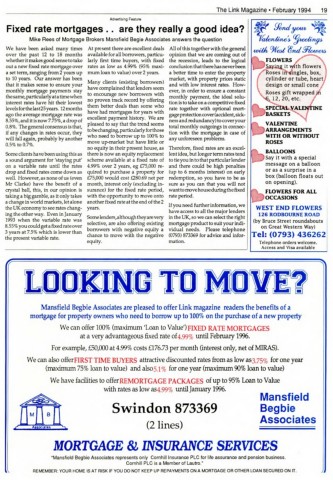

Mansfield Begbie Associates are pleased to offer Link magazine readers the benefits of a

mortgage for property owners who need to borrow up to 100% on the purchase of a new property

We can offer 100% (maximum 'Loan to Value') FD(ED RATE MORTGAGES

at a very advantageous fixed rate of 4.99% until February 1996.

For example, £50,000 at 4.99% costs £176.73 per month (interest only, net of MIRAS).

We can also offerFIRST TIME BUYERS attractive discounted rates from as low as3.75% for one year

(maximum 75% loan to value) and also5.1% for one year (maximum 90% loan to value)

We have facilities to OfferREMORTGAGE PACKAGES of up to 95% Loan to Value

with rates as low as4.99% until January 1996.

Mansfield

Begbie

Swindon 873369

Associates

(2 lines)

A300clat

r1 ' I

MORTGAGE & INSURANCE SERVICES

"Mansfield Begbie Associates represents only Cornhill Insurance PLC for life assurance and pension business.

Cornhill PLC is a Member of Lautro."

REMEMBER: YOUR HOME IS AT RISK IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER LOAN SECURED ON IT.

10,