Page 40 - link magazine

P. 40

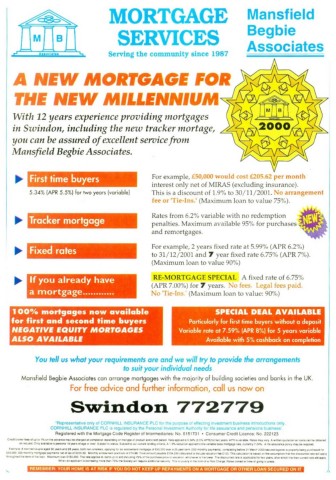

MORTGAGE Mansfield

Begbie

SERVICES

Serving the community since 1987 Associates

A NEW MORTGAGE FOS

THE VFW MILLENNIUM

With 12 years experience providing mortgages

in Swindon, including the new tracker mortage,

you can be assured of excellent service from

Mansfield Begbie Associates.

_ • For example, £50,000 would cost £205.62 per month

interest only net of MIRAS (excluding insurance).

5.34% (APR 5.5%) for two years (variable) This is a discount of 1.9% to 30/11/2001. No arrangement

fee or'Tie-Ins. (Maximum loan to value 75%).

_ Rates from 6.2% variable with no redemption .

Ii7T :o lit.] penalties. Maximum available 95% for purchases

and remortgages.

For example, 2 years fixed rate at 5.99% (APR 6.2%)

• • to 31/12/2001 and 7 year fixed rate 6.75% (APR 7%).

(Maximum loan to value 90%)

• RE-MORTGAGE SPECIAL A fixed rate of 6.75%

(APR 7.00%) for 7 years. No fees. Legal fees paid.

• •1! • No 'Tie-Ins.' (Maximum loan to value: 90 %)

You tell us what your requirements are and we will try to provide the arrangements

to suit your individual needs

Mansfield Begbie Associates can arrange mortgages with the majority of building societies and banks in the UK.

For free advice and further information, call us now on

Swindon 772779

"Representative only of CORNHILL INSURANCE PLC for the purpose of effecting investment business introductions only.

CORNHILL INSURANCE PLC is regulated by the Personal Investment Authority for life assurance and pensions business'.

Registered with the Mortgage Code Register of Intermediaries: No. 5151731 • Consumer Credit Licence: No. 222123

Credit broker lees of up to 1% on the advance may he charged at completion depending on the type of product and credit period. Rate applied is 5.34% (5.5% APR) for two years. APR Invariable Roles may vary. A written quotation on loans can be obtained

on request. Only available to persons 18 years of age or over Subject to status. Subject to our current lending crtaria. A 1.9% reduction applied to the variable base mortgage rate, currently 7.24%. A life assurance policy may be required.

Example: A married couple aged 30 years and 28 years, both nonsmokers, applying for an endowment mortgage of £50,000 over a 25 year term (300 monthly payments), completing before 31 March 2000 secured against a property being purchased for

£55,000. 300 monthly mortgage payments nat of tax of £205.62. Monthly endowment premium of £74.96. Total amount payable 0134,295 calculated to include valuallon lee 0155. This calculation is based on the assumption that the discounted rate will apply

throughout the term of the loan. Maximum loan It 50,000. The rate applies to loans up to and including 75% of the purchase price or valuation, whichever is the lower. The discounted rate is applicable for two years, altar which the than current rate will apply.

When an applicant is borrowing more than 75% the Society will require additional security. This is usually in the form of a Risk Charge. Rates correct at time of going to press.

R EMEMBER: YOUR HOME IS AT RISK IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR OTHER LOAN SECURED ON IT