Due to the huge number of advancements in financial technology over the past few years, FinTech has been introduced into the world and changing the financial industry forever. Statistics show that the rate of investment is growing rapidly, by 45% annually to be precise, with $13.7 billion being invested into start-up plans to help people with financial difficulty. Looking towards the future, the FinTech market is only going to expand and grow, and there are several reasons behind this. Loans Borrowing a loan can be extremely difficult in today’s financial markets, with lengthy processes needing to be carried out before you can even get your hands on some money. With new forms of financial technology in place, the procedure of obtaining a loan will be much simpler than the usual banking method. Startups offer better deals through the technology involved with FinTech, with some programmes offering loans in as little as 24 hours duration. Kabbage, for example, can hand out loans in an impressive time of 7 minutes, which, for students in need of a loan to pay for education, is much more helpful than the average financial market. Specialist lenders are actually increasing their loan flexibility, with mortgages and invoice financing being added into the equation. Risks Associated with Financial Aid FinTech is much cleverer than the usual financial market because of its approach to financial risk. When investing into your business, for example, your credit score plays a very large part in whether you can have a loan from the bank or not. But, with FinTech in the mix, markets are retrieving information from a range of sources, such as social-media reviews to the usage of logistics firms, to calculate whether you should be eligible for financial aid or not. Avant in particular uses innovative technology to underwrite consumers who may have a damaged credit score due to the financial crisis that has occurred. Therefore, FinTech considers how a credit score can be damaged and still lend money over to businesses that need money for investments. Whereas, as a human-driven bank, the judgements are usually very prejudice, making it harder for people to be lent money based on a tiny fault in their credit score. Stronger Credit Landscapes Banks can often encounter a number of risks when it comes to lending money, two of which being mismatched maturities and leverage. Market infrastructure businesses in financial technology are available to help banks and other financial institutions to help avoid these risks, while ultimately helping them to provide the best service to their consumers. This is because they can create more diverse, stable credit landscapes, making money-lending more reliable and stress-free for customers. Where banks take short-term liabilities and alter them into long-term assets, FinTech lenders can simply match borrowers and actually save money directly. This means that the lenders can commit the money until a final payment is due, eliminating any risks a bank might have by borrowing great amounts to even fund lending. Improvements in Business It’s hugely important for businesses to have easy access to money in order to make sensible investments and thus make profit. By having FinTech markets, this can be achieved, as well as the ability to obtain greater access to financial data. With the introduction of this technology, detailed financial software can be utilised, reducing the amount of money that businesses would have to invest in professional, up-to-date programmes and software, as well as IT experts to install it all. Therefore, businesses can gain deep insights into how they need to alter their marketing to reach their primary audiences as well as access financial information such as transactions from their clients.

Business Brief

How Does FinTech Differ From Traditional Financial Markets?

By Staff Reporter - 6 October 2017

BusinessBusiness

Brad Burton to Headline The South West Expo in Swindon

Motivational speaker and entrepreneur Brad Burton ...

Business

Councillors celebrate affordable housing contract

The housebuilder behind the Backbridge Farm ...

Business

Swindon small business owner shortlisted for award

Julita Stefaniak, Founder of J Solutions ...

Business

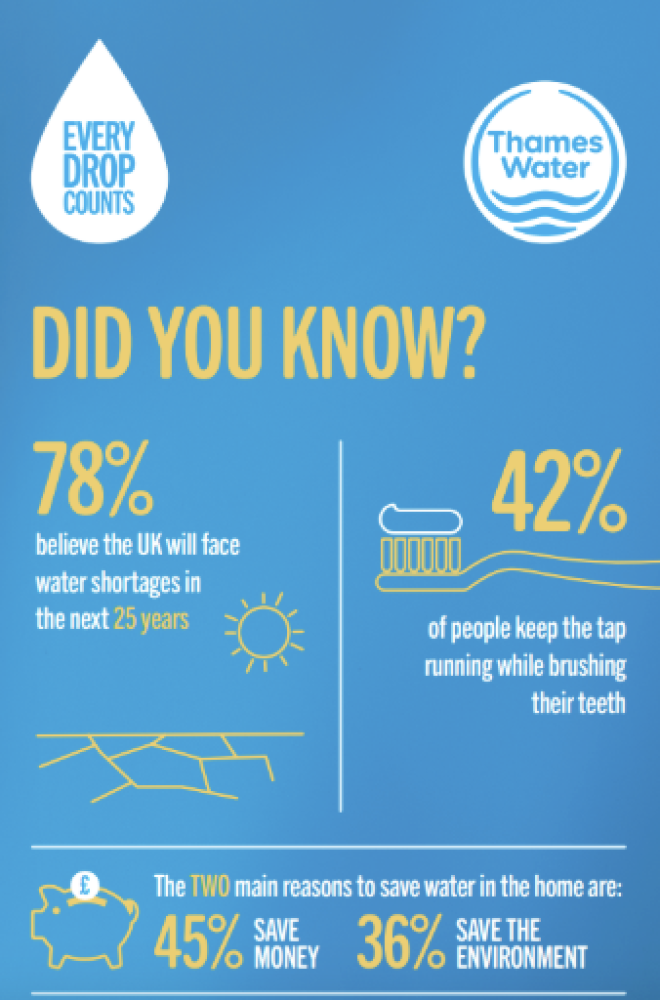

Driest Spring in over a century prompts water-saving advice

Thames Water is reminding its customers ...

Business

GEL Studios launches free summer webinar series

Swindon-based creative agency GEL Studios is ...

Your Comments

Be the first to comment on this article

Login or Register to post a comment on this article