Despite recent fluctuations in prices, property in the UK is still a sound investment compared to other parts of the world. Britain remains a stable society with a robust economy, and over the long term the value of property in this country will always increase. There may be occasional dips, or moments when prices get too high to be sustainable and the market has to re-balance itself, but these checks are all part of why the UK housing market remains healthy and a perennial favourite of investors worldwide. Property should always be looked at as a long-term investment rather than as a way to "get rich quick". The successful property investor weathers the downturns and waits for prices to rise again before selling on. Anyone putting together a property portfolio is advised to use an asset management company to ensure that they get the best possible return on their investments. Shard Capital Partners provides an excellent service in terms of managing property investments across the UK, both big and small. Above average price rises The current UK property market is relatively stable, with a mix of slow growth and slight drops in price across the country. Prices remain significantly higher than their historical average, and of course the picture is different from area to area. One location where demand and prices are rising at a far higher rate than the national average is Swindon. The town was recently rated as the most in-demand place to live in the UK by online estate agent Emoov, and a separate survey suggested that Swindon had the 14th fastest rising house prices in the country. Affordable living That's good news for anyone wanting to sell, and also for buyers and investors, as despite the rising value, Swindon remains much cheaper than nearby cities Reading and Bristol, and certainly far more affordable than London, where demand is falling as buyers find themselves priced out of the capital. A two-bedroom starter home can be bought for £175,000, while in January the average house cost was £231,316. Great transport links Property prices like these are attracting commuters, along with the knowledge that they can get to central London within an hour from Swindon by train. With the M4 accessible via junctions 15 and 16, Bristol and Bath are both half an hour's drive away, while Cardiff can be reached in an hour. For international links, Bristol Airport, Southampton Airport and Heathrow are all within a 65-mile radius. Major employers The town's transport links have made Swindon a major distribution hub for employers such as WHSmith and DHL. Honda, the Nationwide Building Society and Zurich Financial Services also provide an abundance of jobs in the town, and the council's £750m regeneration programme is focused on attracting new businesses, via the construction of new office premises as well as homes and improved leisure facilities. Attractive countryside People living in Swindon enjoy a high quality of life not least because of the closeness to some of Britain's most attractive and iconic countryside. The Cotswolds, the North Wessex Downs and the Welsh border are all within easy reach, as well as world-famous historical attractions such as Stonehenge and Avebury. Swindon also has excellent schools, leisure and recreation facilities, and this quality of life in Wiltshire's green belt coupled with no shortage of employment opportunities means that people are going to continue to want to live, buy and rent in the town for a good while yet. Investment opportunities In 2017, house prices in Swindon rose by an average of £1,400 per month, nearly three times faster than the UK average. Nevertheless, a three-bedroom house in Swindon still costs about the same as a studio flat in Reading. With new-build properties currently under development on the north side of the town being snapped up, it seems that demand shows no signs of slowing down. Swindon also offers investors an above-average rental yield, up to 6.92% for a one-bedroom flat in SN1. While larger properties or those further out offer slightly lower returns, all offer better than 4% yields, making them decidedly worthwhile investments in the buy-to-let market. While the rest of the UK is seeing slow growth and even falling prices as the market in locations such as London readjusts to more realistic expectations, in Swindon the opposite is true. People are waking up to its potential as a great place to live and work, and prices are rising accordingly. For investors, or for those looking to move to the South West, the time to buy in Swindon is now.

Business Brief

Why Swindon is ideal for property investment

By Staff Reporter - 21 May 2018

FeaturesBusinessBusiness

Councillors celebrate affordable housing contract

The housebuilder behind the Backbridge Farm ...

Business

Swindon small business owner shortlisted for award

Julita Stefaniak, Founder of J Solutions ...

Business

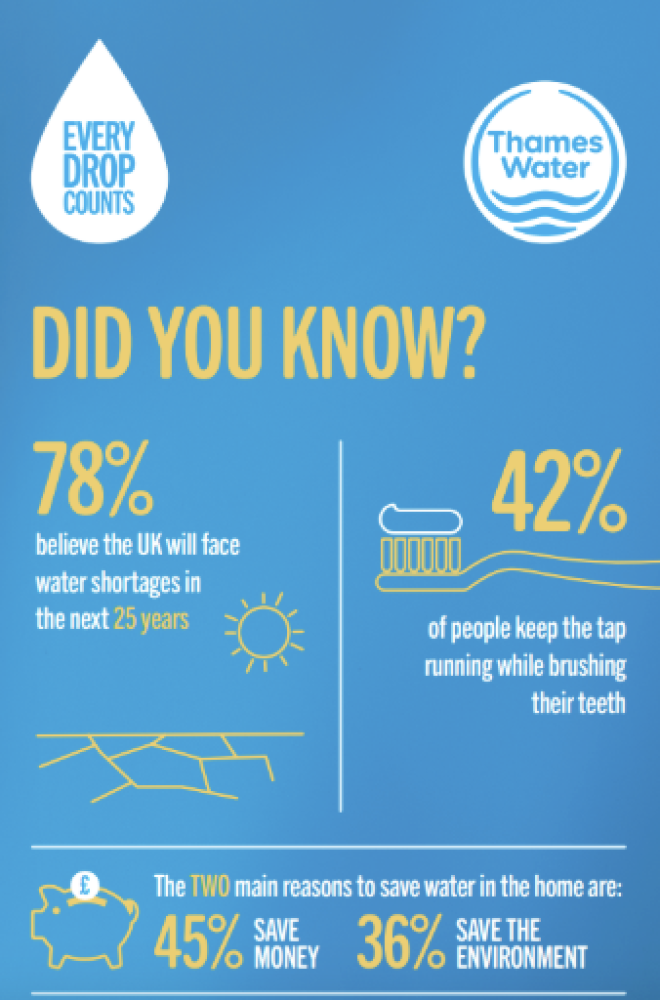

Driest Spring in over a century prompts water-saving advice

Thames Water is reminding its customers ...

Business

GEL Studios launches free summer webinar series

Swindon-based creative agency GEL Studios is ...

Business

Deadline approaches for Swindon’s Bus Company community fund applications

Time is running out for local ...

Your Comments

Be the first to comment on this article

Login or Register to post a comment on this article